The GST department has filed the review petition on the Safari Retreats Ruling after deciding to amend the provisions and correct the ‘plant and machinery’ in the 55th GST Council meeting. It may be a strategy to substantiate the retrospective amendment proposed by the GST council as constitutional.

‘Or’ Controversy In Safari Retreats Ruling

The question is whether the explanation that lays down the meaning of the expression “plant and machinery” in Section 17 will apply to the expression “plant or machinery” used in Section 17 (5)(d).

The expression “plant and machinery” appears at ten different places in Chapters V (Input Tax Credit) and VI (Tax Invoice, Credit and Debit Notes) of the CGST Act.

The department argued that the expression “plant or machinery” appears only in clause (d) of Section 17(5). The use of the word “or” in clause (d) is a mistake of the legislature.

The assessee contended that in the Model GST Law, which the GST Council Secretariat circulated in November 2016 to invite suggestions and comments from the public, the expression ‘plant and machinery’ was used in clauses (c) and (d). However, while enacting the CGST Act, the legislature has consciously chosen to use the expression “plant or machinery” only in clause (d).

Supreme Court In Safari Retreats Ruling

The Supreme Court has pronounced the verdict in the landmark case of Chief Commissioner Of Central Goods And Service Tax And Ors. Versus M/S Safari Retreats Private Limited And Ors. in which it was held that builders are eligible for input tax credit (ITC) on construction costs if building constructed for renting services.

The bench of Justice Abhay Oka and Justice Sanjay Karol has ruled that if the construction of a building was essential for carrying out activity of supplying services such as renting or giving on lease or other transactions in respect of the buildings or part thereof which are covered by clauses 2 and 5 of the Schedule 2 of the CGST Act, the building could be held as a plant. Functionality test will have to be applied to decide whether the building is a plant.

“Error In Drafting GST Act, 2017” Says CBIC Chairman, Sanjay Kumar Agarwal: 55th GST Council Meet

The CBIC Chairman, Sanjay Kumar Agarwal while addressing Press Conference Of 55th GST Council Meet said, “Error In Drafting GST Act, 2017”.

Sanjay Kumar Agarwal while answering the question by a journalist regarding the Safari Retreats Judgement said that it was a pure drafting error because the term ‘Plant and Machinery’ have been used at 11 places, only in one place, it has been mentioned as ‘Plant or Machinery’, so that drafting error has now been corrected with effect from 1 July, 2017. This will require amendment in the GST Act”.

The GST Council has proposed amending the GST Act retrospectively to address the implications of the Supreme Court’s landmark judgment in the Safari Retreats case. In this judgment, the court applied the “functionality test” to determine the availability of input tax credit while distinguishing between the definitions of “plant or machinery” and “plant and machinery.”

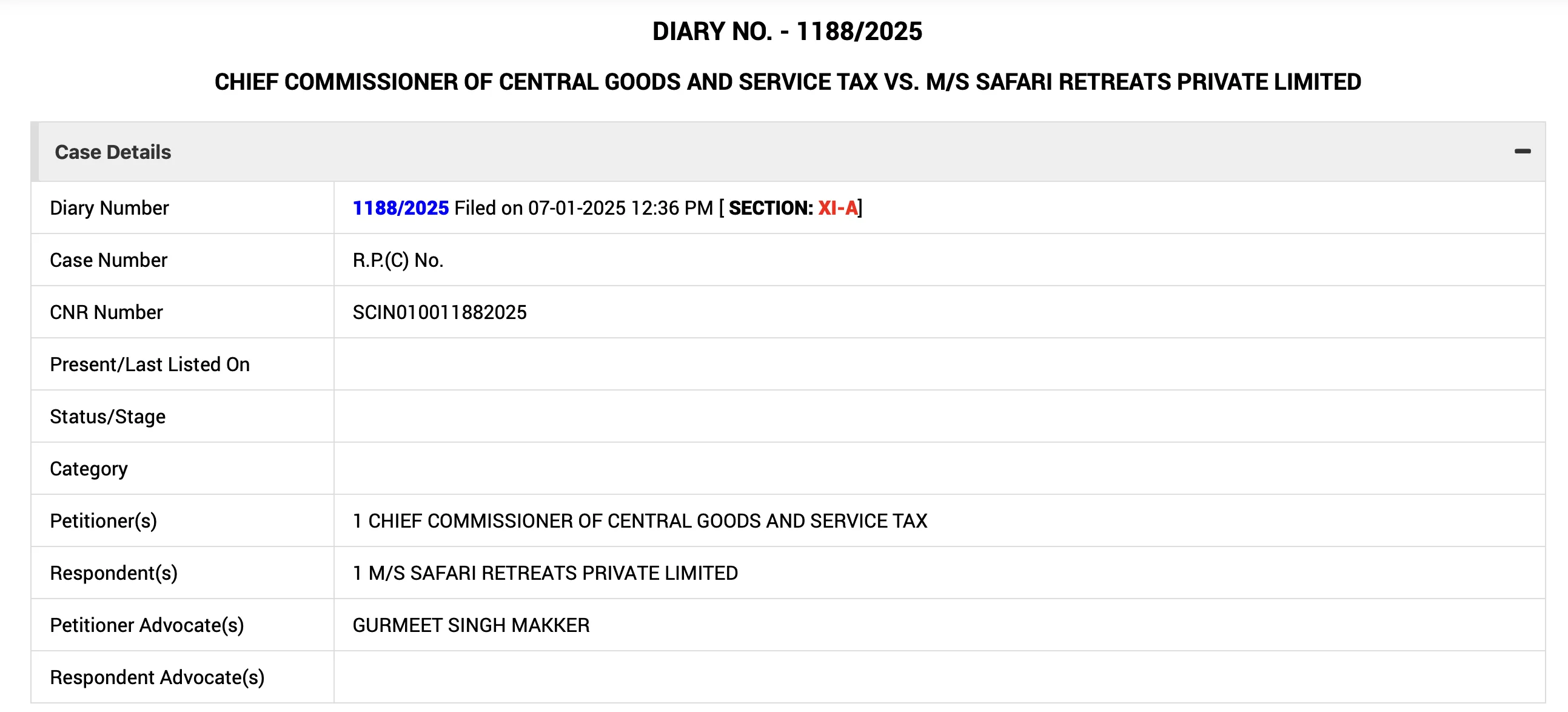

Review Petition On Safari Retreats Ruling By GST Dept.

It may be a strategy to substantiate the retrospective amendment to replace ‘plant or machinery’ with the term ‘plant and machinery’ proposed by the GST council as constitutional.