The Central Board of Direct Taxes (CBDT) has issued the FAQs on the changes proposed by Union Finance Minister Nirmala Sitharaman in Budget 2025-26.

The Board has pointed out both the income tax slab rate under the new regime and proposed new regime introduced by Finance Bill, 2025.

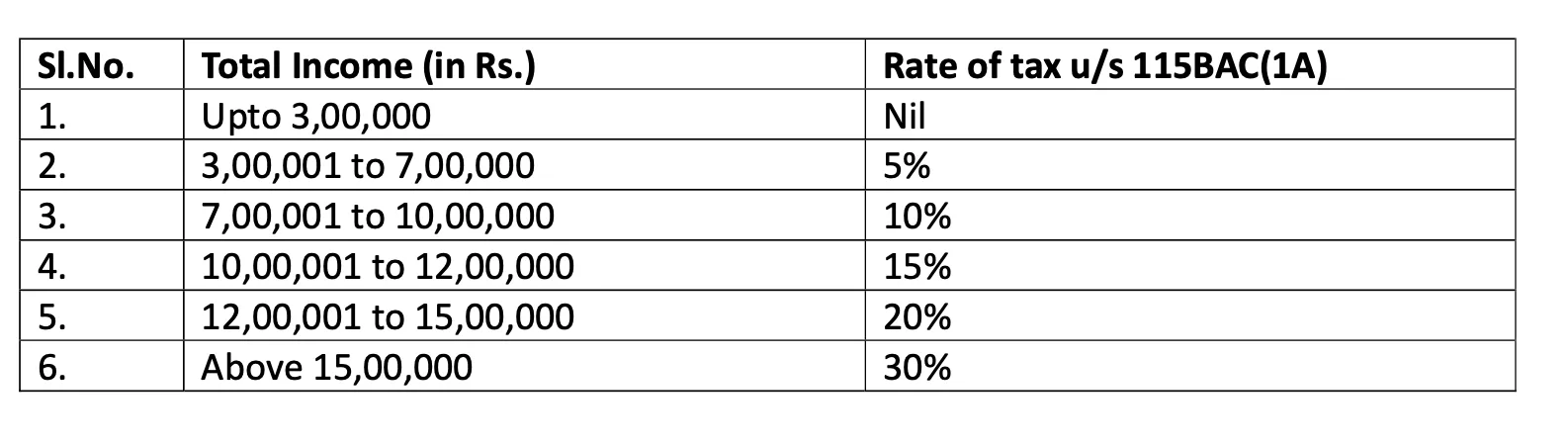

The Finance (No.2) Act, 2024 had the following slabs in the new tax regime for person, being an individual or Hindu undivided family or associaon of persons [other than a co- operative society, or body of individuals, whether incorporated or not, or an artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2

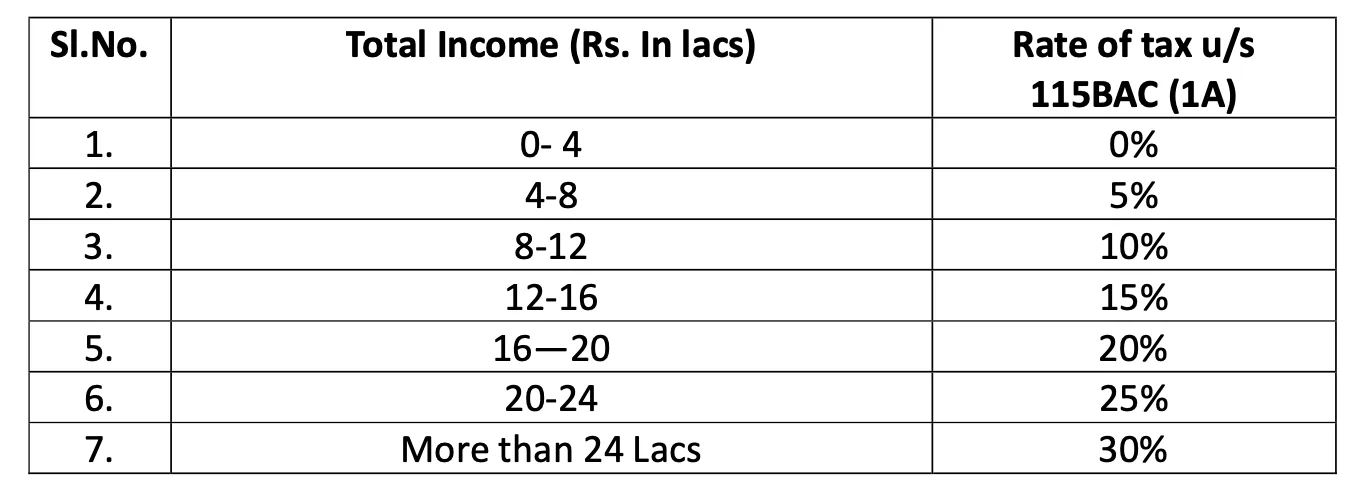

The new slabs proposed are as under:

The Board has clarified that in the proposed new tax regime, the maximum total income for which tax liability for individual taxpayers is NIL is Rs. 12 lakhs.

New tax regime is applicable to person, being an individual or Hindu undivided family or association of persons [other than a co-operative society], or body of individuals, whether incorporated or not, or an artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2. Accordingly, change in tax slabs will benefit all these persons.