The Income-Tax (I-T) department has recently intensified scrutiny on high-income individuals whose bank withdrawals appear disproportionately low compared to their overall spending.

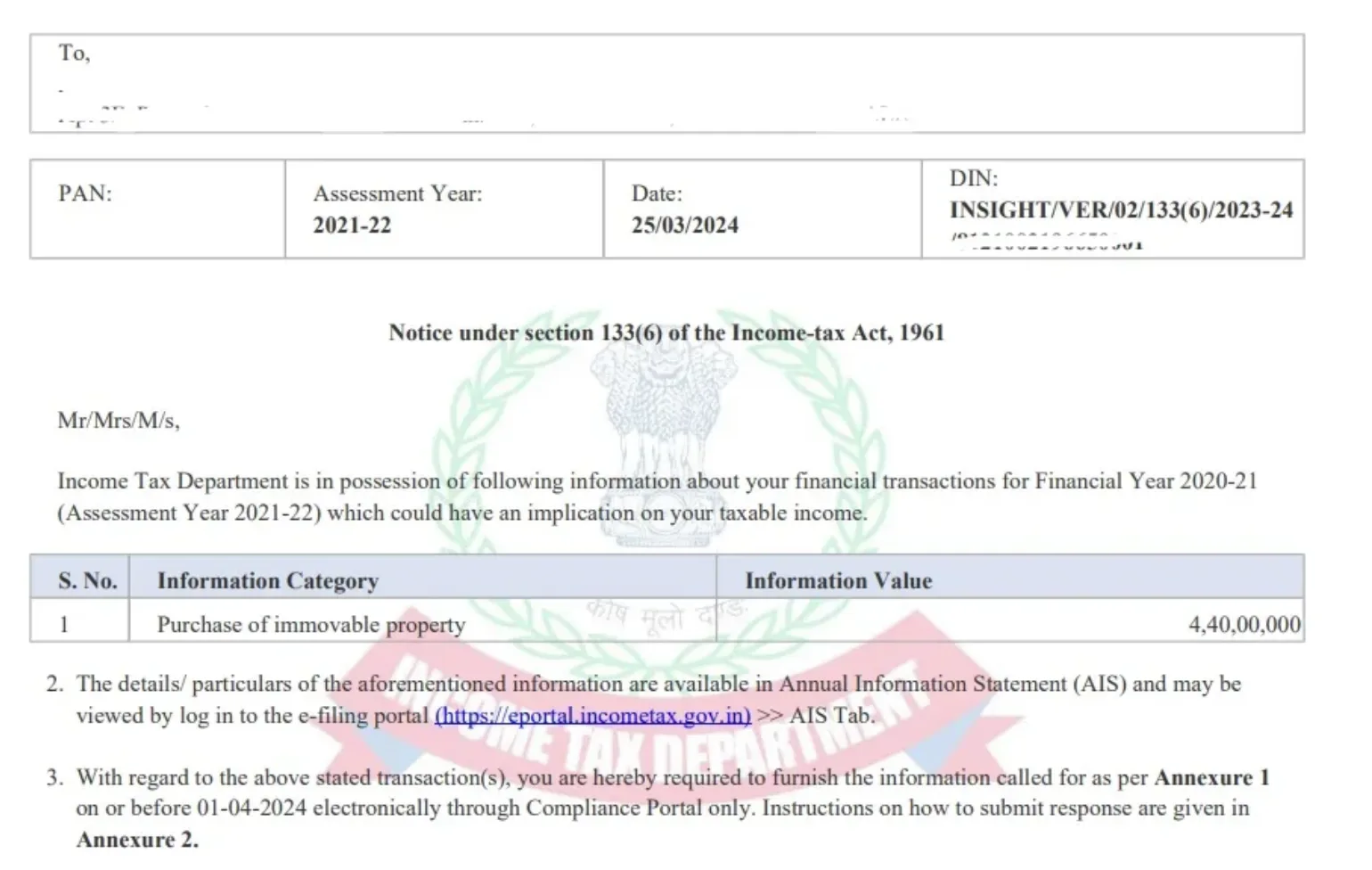

Reports suggest that several individuals have received tax notices, seeking a comprehensive breakdown of their monthly expenditures to identify potential tax evasion.

Why the Crackdown?

Tax professionals highlight that when an individual’s declared income is high but bank withdrawals remain minimal, it raises concerns over unreported cash transactions. Experts suggest that such discrepancies could indicate cash-based expenditures that are not reflected in bank statements.

“Such inconsistencies may suggest individuals are conducting cash transactions that go unreported,” said Suresh Surana, a Mumbai-based chartered accountant. Additionally, authorities suspect that some individuals may be utilizing digital transactions through undisclosed accounts, further complicating income reporting.

In the past, tax scrutiny primarily focused on undisclosed income or unexplained expenditures. However, a new method has emerged—tracking cash expenses that are not backed by proportional bank withdrawals.

“Nowadays, the department has found a third way to identify undisclosed income, by tracking possible cash expenditure that is not supported by sufficient cash withdrawal from your bank account,” said Preeti Sharma, Partner, Global Employer Services, Tax & Regulatory Services, BDO India.

Spending Patterns That Trigger Tax Notices

Certain spending behaviors can raise red flags, prompting tax authorities to issue notices. Sharma outlined some key indicators that could lead to scrutiny:

- Paying car EMIs but lacking corresponding fuel expenses reflected in withdrawals or online payments.

- Booking airline tickets for vacations without sufficient cash withdrawals or online hotel bill payments.

- Sending foreign remittances for education fees while failing to show withdrawals for living expenses.

- Purchasing high-value items such as luxury goods or real estate without corresponding withdrawals or documented online transactions.

“Red flags that could trigger a tax notice include spending patterns that do not match bank withdrawals, lavish expenditures on luxury items, real estate, or high-end gadgets that are inconsistent with declared income,” said Shefali Mudra, a tax expert at ClearTax.

How to Respond to an I-T Notice

Experts advise that taxpayers must respond promptly with a detailed and well-documented reply justifying their income and expenditures. Queries raised by the assessing officer (AO) should be addressed satisfactorily to avoid any tax additions.

“If the replies are not satisfactory or do not justify the expenses, there could be an addition to the person’s taxable income, along with interest and penalty,” explained Gaurav Jain, Partner, Direct Tax, Forvis Mazars in India.

Failure to explain discrepancies can lead to serious consequences. “Penalties may include fines of up to 200 per cent of the tax payable on underreported income. In cases of wilful concealment or evasion, further legal actions, including audits of past returns and even prosecution, could follow,” warned Mudra. In extreme cases, imprisonment is also a possibility.

With tax authorities leveraging advanced data analytics to track financial irregularities, experts advise taxpayers to maintain transparent financial records and ensure that high-value expenditures align with bank transactions to avoid unwanted scrutiny.

Read More: Many Taxpayers Receive Emails on Outstanding Income Tax Dues: Here’s What You Can Do