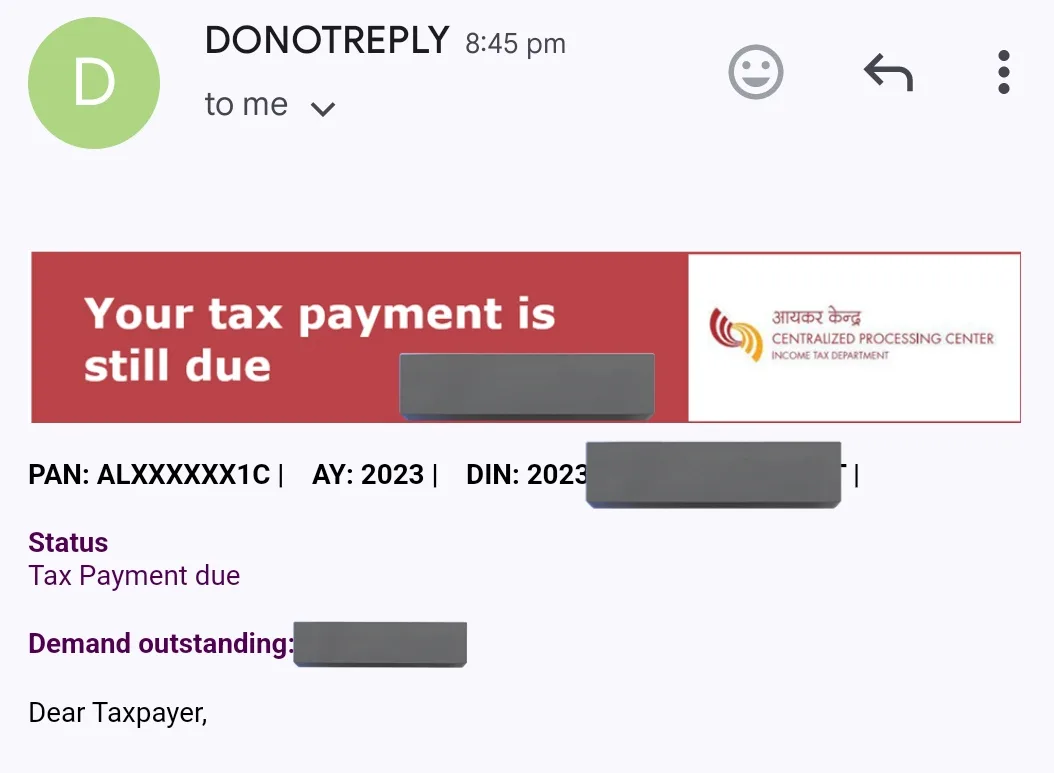

Several taxpayers across India have reported receiving official emails from the Income Tax Department notifying them about their pending tax dues. The emails, sent from “DONOTREPLY” addresses, alert taxpayers that their tax payment is still due for the Assessment Year 2023. The messages include details such as PAN, Assessment Year, Document Identification Number (DIN), and the outstanding amount.

The email is issued by the Centralized Processing Center (CPC) of the Income Tax Department, urging taxpayers to clear their dues at the earliest. The subject line of the email and the red-highlighted banner stating “Your tax payment is still due” emphasize the urgency of the matter.

Legitimacy and Precaution

Many taxpayers, concerned about potential fraud, have questioned the authenticity of such emails. However, tax professionals advise that official communication from the Income Tax Department usually carries a DIN (Document Identification Number), which can be verified on the official Income Tax e-filing portal (https://www.incometax.gov.in). Taxpayers are advised to cross-check their tax liabilities by logging into their e-filing accounts before making any payments.

Reasons for Outstanding Tax Dues

The outstanding tax demand may arise due to various reasons, including:

- Mismatch in TDS (Tax Deducted at Source) credits

- Incorrect self-assessment tax payments

- Discrepancies in income tax return filings

- Adjustments made by the tax department during processing

What Should Taxpayers Do?

Taxpayers who have received such emails should take the following steps:

- Log in to the Income Tax Portal – Verify the demand under the “Pending Actions” tab.

- Verify Tax Credits – Check Form 26AS and AIS (Annual Information Statement) to ensure correct TDS credits.

- Respond to the Demand – If the demand is incorrect, taxpayers can file a rectification request or respond to the demand online.

- Make the Payment – If the demand is accurate, payment can be made through the portal’s e-Pay Tax facility.

Avoiding Scams

While the official tax department emails are legitimate, cybercriminals often attempt phishing scams by sending fake tax notices. Taxpayers should avoid clicking on links in suspicious emails and always verify the authenticity through the official Income Tax Department portal.

For further assistance, taxpayers can contact their Chartered Accountants or seek help from the Income Tax Department helpline.

Read More: DGFT Amendments Export Policy Of Broken Rice