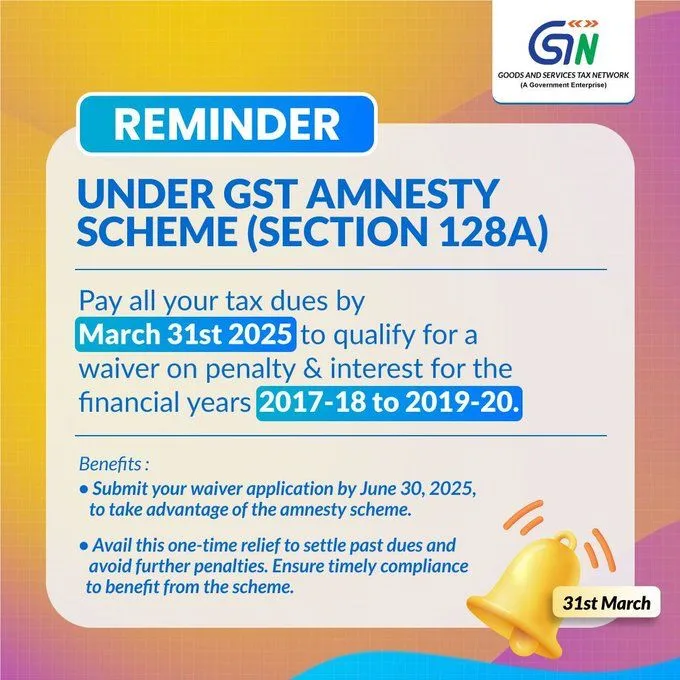

The Goods and Services Tax Network (GSTN) has issued a crucial reminder for taxpayers to clear their outstanding tax dues under the GST Amnesty Scheme (Section 128A) before the March 31, 2025 deadline.

This initiative provides a significant relief by waiving penalties and interest on pending tax liabilities from the financial years 2017-18 to 2019-20.

Key Highlights of the GST Amnesty Scheme

- Deadline to Pay Dues: March 31, 2025

- Financial Years Covered: 2017-18 to 2019-20

- Waiver Applicable: Penalty & Interest

- Waiver Application Deadline: June 30, 2025

Benefits of the GST Amnesty Scheme

- Avoid Heavy Penalties – Taxpayers with outstanding GST liabilities from the specified years can clear dues without incurring penalties and interest.

- One-Time Relief – A chance to settle past obligations and prevent further compliance issues.

- Extended Time for Application – Even after paying dues by March 31, 2025, businesses can submit their waiver application until June 30, 2025.

Why Taxpayers Should Act Now?

With the deadline fast approaching, businesses and individuals are urged to take advantage of this scheme to avoid accumulating penalties and legal complications. The GSTN has emphasized the importance of timely compliance to benefit from this relief.

How to Apply?

- Log in to the GST portal and check for pending dues.

- Make the necessary tax payments before March 31, 2025.

- Submit the waiver application by June 30, 2025.

Conclusion

This GST Amnesty Scheme is a golden opportunity for businesses to regularize their tax compliance and ensure a smooth financial standing. Missing the deadline could result in heavy penalties and interest accumulation. Act now and settle your GST dues before the cutoff date!

Read More: Customs Officials Rescue Endangered Monkeys Smuggled from Malaysia to Bengaluru

![GSTAT Notifies Goods and Services Tax Appellate Tribunal (Procedure) Rules, 2025 [READ RULES] GSTAT Notifies Goods and Services Tax Appellate Tribunal (Procedure) Rules, 2025 [READ RULES]](https://www.jurishour.in/wp-content/uploads/2025/02/GSTAT-218x150.webp)