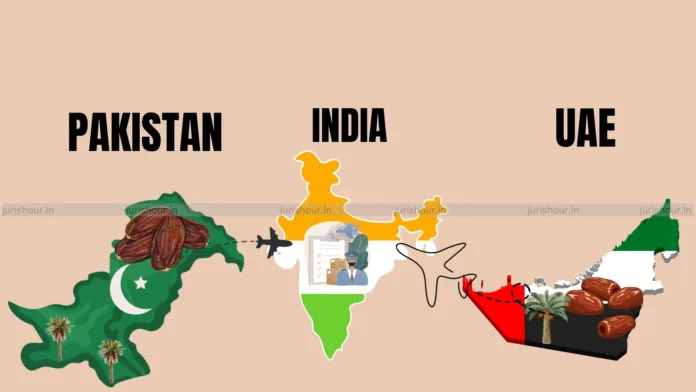

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has quashed the penalty imposed on the Indian Importer as the customs dept. failed to prove dry dates were of Pakistan origin and not from UAE.

The bench of Justice Dilip Gupta (President) and P. V. Subba Rao (Technical Member) has observed that the Principal Commissioner was not justified in ignoring the certificate of origin issued by the competent authority in UAE. In the absence of a finding by the competent authority that this is a fake certificate, this certificate would conclusively prove that the imported goods originated from the UAE.

The appellant/assessee claimed that its representative negotiated with M/s. GVO Global FTZ, UAE for import of dry dates of UAE origin. Accordingly, a sales contract dated 02.07.2019 was entered into for supply of 55 MT of dry dates at the rate of USD 630/KG.

The appellant filed a Bill of Entry dated 09.08.2019 and submitted commercial invoice, packing list, fumigation certificate issued by Universal Pesticides Trading Co. (LLC), Certificate of Origin dated 16.07.2019 issued by Ajman Chamber of Commerce, UAE, and phytosanitary certificate issued by Plant Protection Organization, UAE.

Read More: DGFT Updates Export Policy Of All Products In Line With Finance Act 2024

According to the appellant, all these documents declare that the dry dates that were being imported were of UAE Origin.

The appellant claims that the containers were examined by the proper officer and after due verification and on being satisfied that the declaration made by the appellant was true and correct, the goods were assessed to duty and the goods were given out of charge on payment of duty. The appellant, thereafter, sold the said consignment to buyers.

However, a show cause notice was issued to the appellant alleging that dry dates imported by the appellant were of Pakistan origin based on the Export Declaration and the container tracking report submitted by the freight forwarder.

The appellant contended that the genuineness of the certificate of origin issued by the Ajman Chamber of Commerce, UAE which was submitted by the appellant before the Customs was not controverted in the show cause notice.

The appellant contended that the allegation made in the show cause notice that the importer colluded with his supplier and obtained the county of origin certificate on the strength of false documents was incorrect. The appellant also pointed out that no reliance could be placed on the Export Declaration and the container tracking report submitted by the freight forwarder.

The department contended the Export Declaration provided by the freight forwarder and the container tracking details provided by the freight forwarder confirm that the container containing the goods originated from Karachi Port and, therefore, the actual origin of the imported goods is from Pakistan and not UAE.

The issue raised was whether the dry dates imported by the appellant through invoice and Bill of Entry originated from UAE or from Pakistan.

THe tribunal held that the goods imported by the appellant originated from UAE and not from Pakistan.

The CESTAT held that it cannot be said that the appellant had willfully mis-stated facts or suppressed facts. These are necessary ingredients for applicability of the provisions of section 114 A of the Customs Act. The statement was made by the appellant in the Bill of Entry on the basis of documents, and these documents had been examined by the proper officer and, thereafter, the goods were cleared on payment of duty. The imposition of penalty under section 114A of the Customs Act on the appellant is unjustified and is liable to be set aside.

Case Details

Case Title: S. S. Overseas Versus The Principal Commissioner of Customs

Case No.: Customs Appeal No. 51433 of 2022

Date: 14.01.2025

Counsel For Appellant: Tarun Gulati

Counsel For Respondent: Rajesh Singh